Blog

Stay up to date on non-resident taxes in Spain

New obligation related to the NRA: declaration of rental stays in 2025

Owners with a definitive NRA must submit the annual information return for their tourism activity in…

Consequences of failing to submit Form 210 on time: penalties, surcharges and ways to rectify it

Penalties and interest for failing to submit Form 210

Rental Income Tax in Spain: Answering The 15 Most Common Questions

Non-residents renting in Spain? Get clear answers to 15 common rental income tax questions, includin…

Deductible Rental Expenses in Spain for Non-Residents: Full 2025 Guide

Can non-EU/EEA residents in Spain deduct rental expenses like utilities, repairs, insurance, and man…

Essential Annual Checklist for Non-Resident Property Taxes in Spain

Free annual checklist to simplify non-resident property tax filing in Spain and avoid last-minute st…

How to correct errors in Form 210: Supplementary and Amended Return

Non-residents must submit Form 210 and may correct errors with supplementary or amended returns.

Your Complete Guide to Non-Resident Property Taxes in Spain 2025

Your 2025 guide to filing Modelo 210 for non-resident property taxes in Spain - clear, simple, stres…

IberianTax Selected Among the Top 101 Startups in Spain at the Spain Up Nation Awards (Edition II)

IberianTax named among Spain’s Top 101 startups, leading the Balearic Islands with innovation in dig…

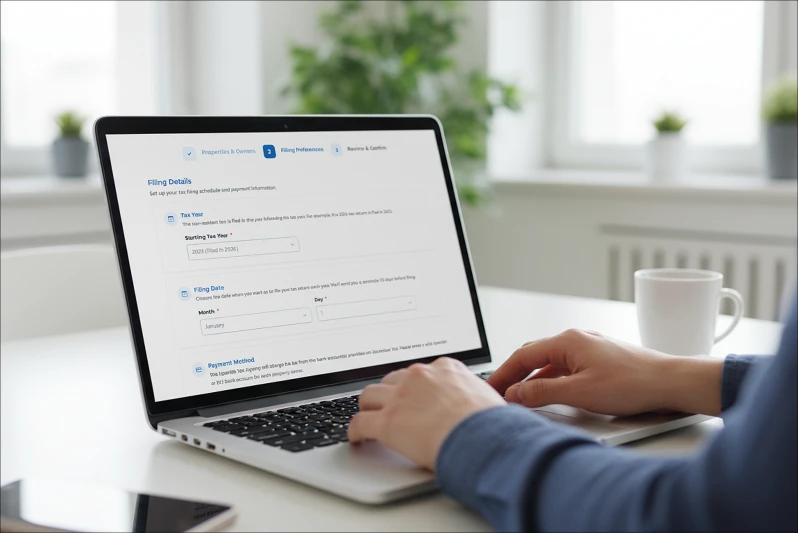

Automatic Filing for Non-Resident Taxes: Discover The Future of Compliance

Automate your Spanish non-resident taxes with IberianTax. Set it up once, and we’ll handle it automa…

National Court ruling: deduction of rental expenses in Spain for non-EU owners.

Spanish court may allow non-EU property owners in Spain to deduct rental expenses, challenging the c…

European Commission Challenges Spain's Tax Treatment of Non-Resident Property Owners

Spain Faces EU Proceedings Over Non-Resident Property Tax Treatment

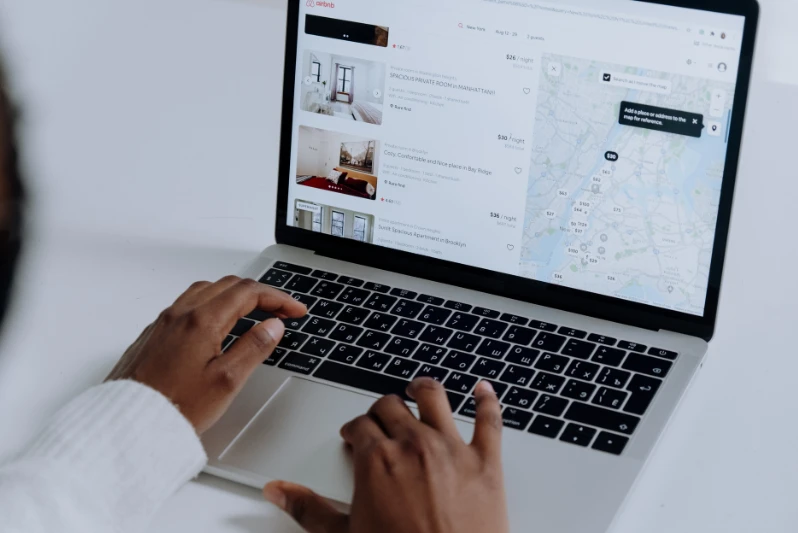

Airbnb and other platforms will remove unregistered listings: the new reality of holiday rentals

Starting August 2025, Airbnb will remove Spain listings without a valid NRA. Register now to stay co…