How to Download Your IBI Receipt in Almería

February 8, 2024

As a non-resident property owner in Almería, ensuring you have your IBI receipt handy is essential when filing your Imputed Income tax return. In this guide, we'll take you through the straightforward steps to download your IBI receipt in Almería.

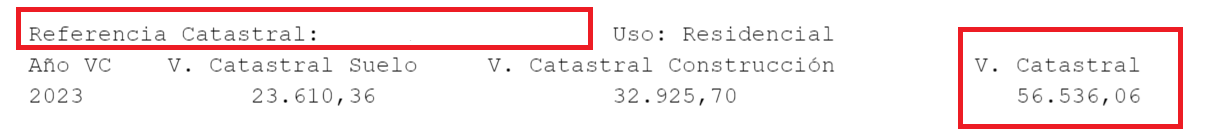

Understanding the significance of your IBI receipt is crucial before delving into the downloading process. This receipt holds vital details, such as the cadastral value and reference of your property, indispensable for accurately completing your non-resident property tax returns in Spain. Whether you're well-versed in property ownership or just starting, having your IBI receipt on hand guarantees a seamless and error-free property tax filing experience.

Occasionally, when property tax (IBI) payments are debited directly from our bank accounts, we receive confirmation of payment, but not the actual receipt. In this guide, we'll walk you through the process of obtaining your IBI receipt if you own property in Almería:

1. First of all, you’ll need to click on the following link: https://recaudacion.dipalme.org/ to visit the Virtual Tax Office of the Almeria Provincial Council.

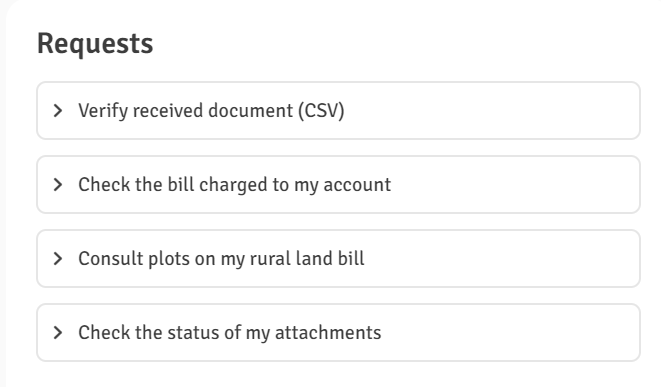

2. Head to the ‘Requests’ section towards the bottom left hand side of the page and choose the option ‘check the bill charged to my account’.

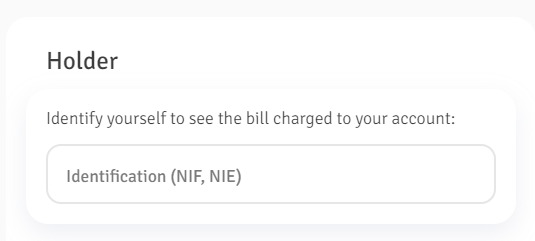

3. Next, we will need to enter the taxpayer's tax identification number. This may be your NIE number.

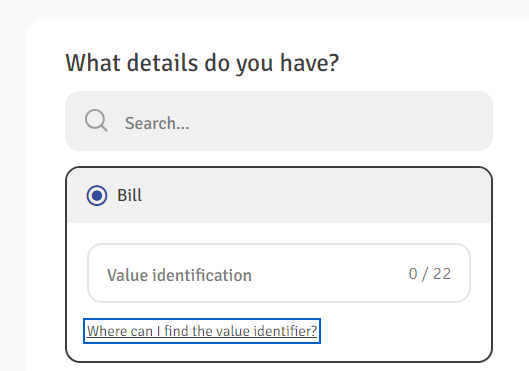

4. Then, choose the document that we have at our disposal. In this case, it is the bank receipt. Therefore, we need to select ‘receipt’.

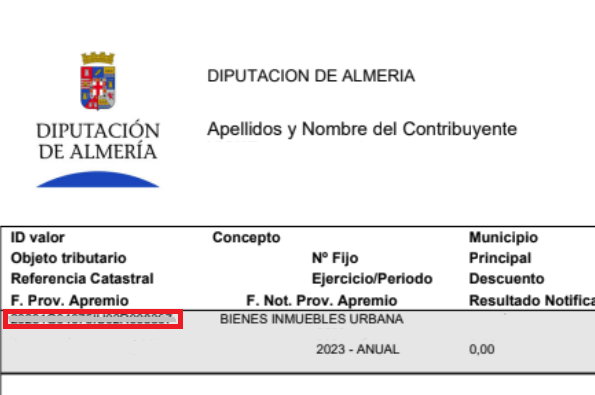

5. You will then be asked for the ‘value identification’. This value will be referenced in different ways, but it should always have a maximum of 22 characters and is detailed as ‘ID value’.

6. When you introduce the code, it will then give you the option to download the receipt in which you will find the cadastral value.

Understanding Non-Resident Taxes in Spain

Beyond the IBI tax, non-resident property owners in Spain must navigate various other tax obligations. Depending on how you use your property, you may face annual or quarterly tax responsibilities that require filing using the Modelo 210 tax form.

For properties solely for personal use, whether vacant year-round or not, filing a Modelo 210 form for Imputed Income tax by December 31st for the previous year is essential. Conversely, if you rent out your property, annual submission of a Modelo 210 form for Rental Income tax is necessary.

Luckily, IberianTax streamlines the process of submitting your Modelo 210 directly to the Spanish tax authorities, starting from just 34.95€! Our intuitive online tax software guides you through preparing and submitting your Imputed Income, Rental Income tax and even your Capital Gains Tax returns seamlessly, regardless of your previous tax-filing experience.

Just follow our step-by-step questionnaire, and we'll handle the review and filing on your behalf and send it to the authorities, it’s that simple! To find out more about our service, click here.