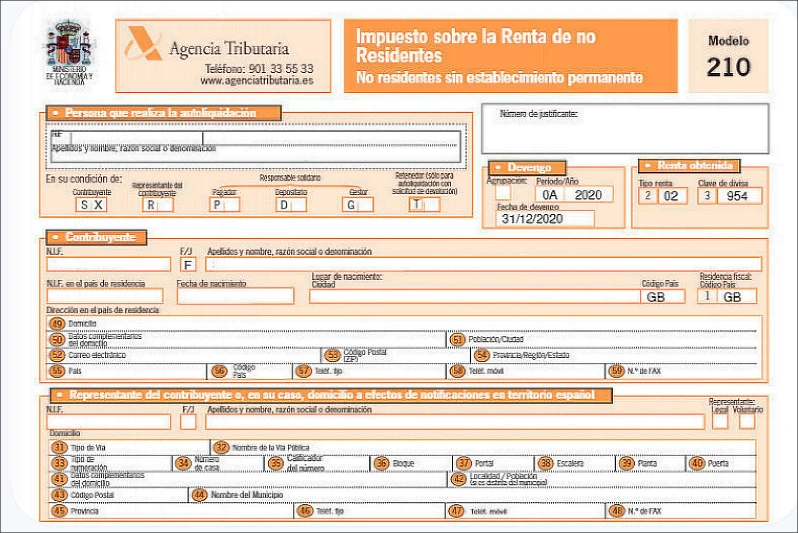

A simple guide to Spanish Tax Form 210 (“Modelo 210”)

September 7, 2021

What is Modelo 210 in Spain?

Modelo 210 is the official tax form for filing the Spanish Non-Resident Income Tax, commonly referred to as “IRNR” or “non-resident property tax”.

Who needs to file Modelo 210?

Among other taxpayers, any non-resident property owner in Spain must submit Form 210 to the Agencia Tributaria, whether the property is rented out or not.

Am I a tax resident in Spain?

An individual is classified as a tax resident in Spain when any one of the following circumstances applies. Otherwise, an individual is considered a non-resident in Spain for tax purposes.

- To stay longer than 183 days in Spanish territory over the calendar year. In order to determine the permanence in Spanish territory, occasional absences are included, except if the taxpayer accredits their residency in another country. In the case of countries or territories labelled as tax havens, the Spanish tax authorities can demand proof of stay in that tax haven over a period of 183 days within the calendar year.

- To situate the main base or centre of their activities or economic activities, directly or indirectly, in Spain.

- To have dependent not legally separated spouse and/or underage children who are resident in Spain. The latter accept evidence to the contrary.

Additionally, individuals of Spanish nationality who accredit their new tax residence in a country or territory labelled as a tax haven will not lose their status as tax residents.

Where can I find Modelo 210 tax form?

You can complete Modelo 210 tax form on the official website of the Spanish tax authorities (AEAT): https://www.agenciatributaria.gob.es.

You can decide whether you would like to submit your Form 210 by paper or online. However, filling in the form is only available online. Online is by far, the easiest way to file your Spanish non-resident tax return, especially if you choose to use IberianTax.

How can I file and pay Form 210 in Spain?

Online

Filing and paying your non-resident taxes online is much easier, and beats printing the form and going physically to your Spanish bank office to pay your tax. All you need to do is create an account with IberianTax, add your personal and property details and file with confidence. Our easy-to-use software will guide you through the filing process, whilst instantly updating all tax calculations.

Important Note: Online tax filing is not available through the AEAT’s website unless you have an electronic certificate in force issued by the Spanish authorities. In Spanish is known as Certificado Electrónico de Persona Física.

Paper

If you prefer to file your Form 210 by paper, you can complete the tax form via AEAT’s website or using our tax tool, but remember you have to print the form out and go to Spain in order to pay the tax through your Spanish bank office before the tax deadline. Otherwise, you may incur penalties and interest.

If you’re unsure about how to fill in your Modelo 210 tax form, you can file your Form 210 in minutes with confidence using our simple tax tool. You won’t believe how easy we make it! Click here and submit your non-resident tax return today!

When must I submit Form 210? What is the deadline?

The deadline depends on the type of income you must declare.

- Imputed income from unleased properties: The tax deadline is December 31 of each year with respect to the previous calendar year. In the case of online submission, the payment of the tax liability can be domiciled from January 1 to December 23.

- Rental income: Starting from the 2024 tax year, the declaration of rental income will be annual, with the filing deadline set between January 1 and January 20 of the following year.

- Capital gains and losses from property sales: They must be declared within four months after the date of sale.

If you’re unsure how to fill in your Modelo 210 tax form, you can file your Form 210 in minutes with confidence using our simple tax tool. Click here and submit your non-resident tax return today!