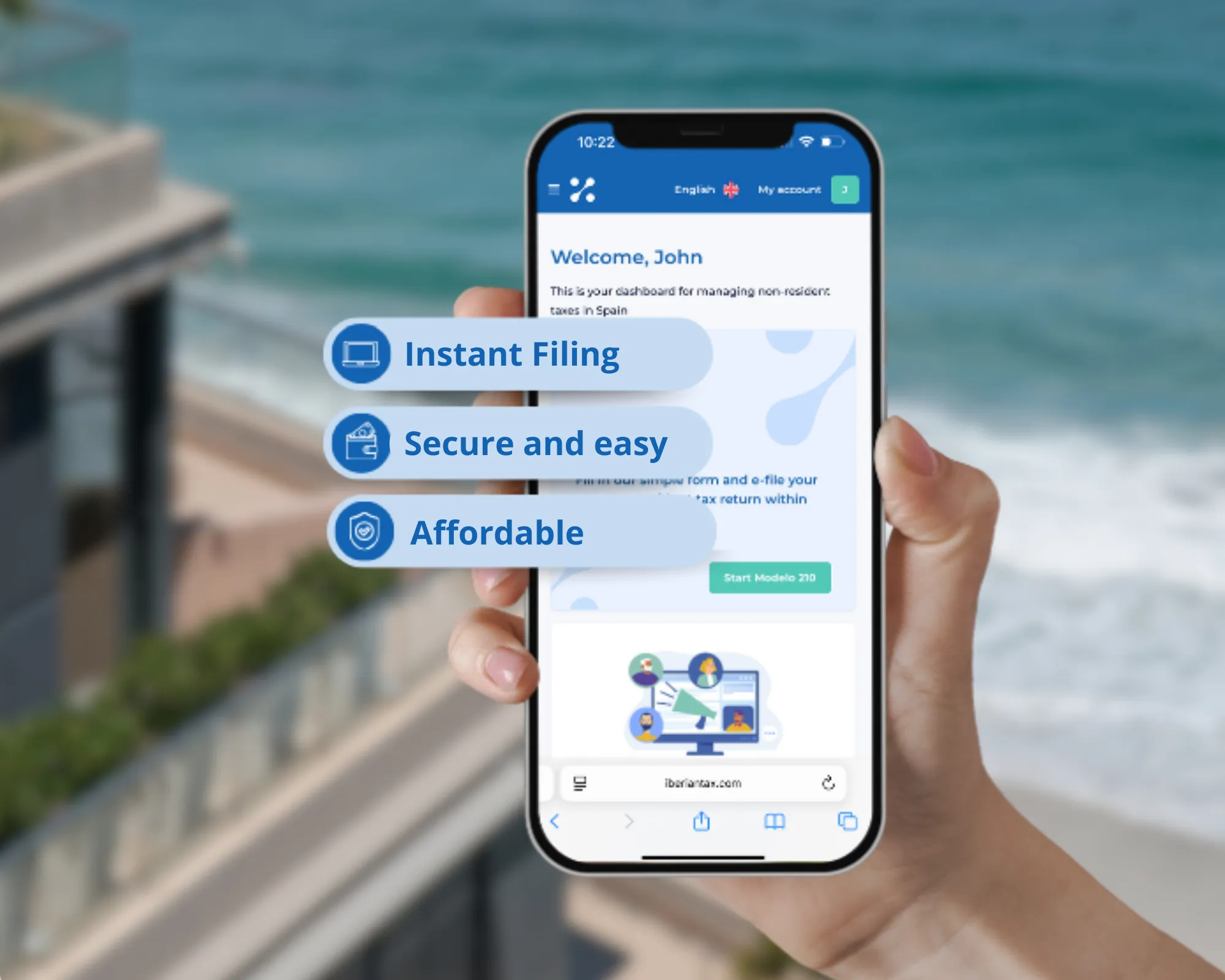

Simple Online Tax Filing for Non-Residents in Spain

File your Spanish property taxes (Modelo 210) online in minutes. No paperwork, no jargon, and 100% compliant with the Spanish Tax Agency.

What Modelo 210 do I need to file?

As a non-resident property owner in Spain, your tax obligations depend on whether your property is for personal use, rented, or being sold.

Imputed Income

Mandatory for non-residents even if the property is vacant or used for personal purposes.

Rental Income

Required for declaring rental income from holiday lets or long-term rentals in Spain.

Capital Gains

Required when selling property in Spain, including claiming the 3% withholding refund.

How It Works

Register for free

Create your account in seconds or log in. No credit card required.

Fill out your information

Answer a few simple questions about your property and its ownership.

Review, pay & file

We calculate your tax, you confirm, and we submit directly to the Agencia Tributaria.

You've successfully filed your taxes!

It takes less than 10 minutes to file your non-resident declaration with the Spanish tax authorities. You’ll receive your official filing receipt in your dashboard and via email within 2 business days.

Why file with IberianTax?

Fast & simple

File your Modelo 210 in minutes, no Spanish paperwork or jargon.

Deadline reminders

Never miss a deadline. We notify you so you never risk late fees or penalties.

Automatic annual filing

Set it once and IberianTax takes care of your yearly filing automatically.

Accurate & affordable

Always compliant with Spanish tax law, with transparent fees far lower than gestorías.

All-in-one dashboard

Manage properties, owners, and filings from one secure dashboard

Reliable tax support

Quick answers in your language, whenever you need us.

Pricing

Pay only when you file, no hidden fees.

Price per property. Garages and storage rooms are filed separately starting at €29.95. For 5+ owners or multiple properties, pricing is calculated in the checkout.

What Our Clients Say

25,000+ Modelo 210 filings completed

Trusted by Property Owners Across Spain

Join hundreds of satisfied clients who chose the smart way

Step-by-step questionnaire

Guided questions adapt to your property and tax situation.

Automatic tax calculations

Instant and always up to date with Spanish tax rules.

Error-checking before filing

We verify your data to prevent mistakes before submission.

Official AEAT receipts

All your official tax receipts stored in your dashboard.

The simple solution for filing your non-resident taxes in Spain

Save time, save money, and skip the paperwork.

Frequently Asked Questions

If you have more questions, please check our full FAQ page or contact us directly.